Thailand’s rental market has evolved dramatically since 2021. After the COVID-19 slump when international arrivals nearly halted, the market began rebounding through 2022–23 as tourism and remote work boosted demand. By 2024, city rentals surged with foreign and local tenants, and by 2025 yields hover around 6% on average. This guide delves deep into Thailand’s rental sector – its history, property types, regional nuances, costs, legal framework, tenant profiles, market trends, and future outlook. It is aimed at expats, digital nomads, retirees, and students seeking long-term stays or relocation. We cover everything from historical price changes and provincial breakdowns to lease clauses and common pitfalls.

Thailand’s rental market was profoundly shaped by COVID-19. In 2021, strict border closures left only 430,000 foreign tourists, a fraction of the 39.8 million in 2019. With tourism near zero, many property owners sought domestic tenants or converted rentals to long-term leases. In early 2022, the market bottomed out, but demand began recovering as Thailand reopened. By late 2022, 11.15 million international tourists arrived, and Q1 2023 saw 6.5 million visitors – more than half of 2022’s total. This tourism rebound, coupled with the global remote-work trend and the introduction of long-stay visas (e.g. the 5-year Destination Thailand Visa in 2024), has sharply raised occupancy.

Economically, Thailand’s GDP growth picked up from 2.6% in 2022 to an expected 3.4% in 2023. The surge in tourism and easing restrictions have driven a near-full recovery: 2024 saw 35.5 million tourist arrivals (up 26% YoY) and accommodation occupancy at 71.5%, exceeding pre-pandemic levels. This has translated into rising rents. For example, Bangkok’s prime condos saw average rents rise ~9% YoY by mid-2024. Meanwhile, new construction slowed (permit issuances down 33% in Bangkok metro Q1–Q3 2024 vs. 2023), limiting new supply. Developers have focused on mid-market segments (projects under 7 million THB).

Rent prices in 2021–2022 were volatile. In 2022, for instance, Bangkok saw a median condo rent of ~THB 187,772 (Q2) drop to THB 116,947 (Q3) as supply outpaced demand. Houses plunged from THB 116,000 (Q2) to THB 21,000 (Q3) due to oversupply from downsizing Thais. By 2023, stability returned: Bangkok condo rents averaged ~THB 45,000–47,000. In sum, the structural picture is a landlord-friendly market (no rent controls, standard 1–3 year leases) with rents now rising modestly as tourism and expat demand return.

Foreign renters in Thailand typically choose among condos, apartments, houses/villas, and townhouses, each with distinct layouts and tenant profiles:

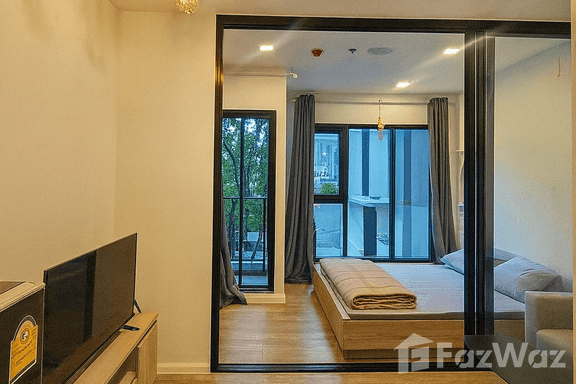

Modern Bangkok condo. Condominiums typically feature 1–3 bedrooms, built-in kitchens and share amenities (pool, gym, security). They suit professionals and nomads looking for convenience, though rents can be high (1 BR in central Bangkok ~20,000–50,000 THB). Townhouses offer a balance of space and cost, while standalone villas (often near beaches) provide luxury but command the highest rent.

In short, expat renters often prefer central condos in big cities (for easy commute and international schools), digital nomads lean toward modern condos or co-living spaces in urban hubs, retirees favor tranquil villas/townhouses in resort towns, and students usually share apartments or rent cheap rooms near universities. Service apartments (short-term fully serviced condos) also exist but cost 2–3× normal rent. Importantly, all these property types are widely available through agents or online platforms, but foreigners should verify titles (condos can be freehold, houses usually leasehold) and negotiate terms.

Thailand has six major expat rental markets, each with distinct districts:

Bangkok – the nation’s economic and transportation hub – offers the widest selection of rental housing, but also the highest prices. Key expat areas include:

Bangkok’s market is heavily segmented: central districts command premiums, whereas suburban areas (Bang Na, Nonthaburi across the river) offer bargain rents with longer commutes. A good public transit (BTS/MRT) is often essential. Traffic can make short distances 30–60 min by car in rush hour, so many prefer living near a train line. International schools (e.g. BIS, NIST, Concordian) and hospitals (Samitivej, BNH) draw expat families to specific neighborhoods. Overall, Bangkok satisfies almost every renter profile, from corporate executive in a sky-high condo to young professional in a serviced apartment.

Chiang Mai, the cultural heart of the north, is Thailand’s second expat magnet after Bangkok. Its city centre covers only ~10 km, so commute times are short (within 30 minutes by motorbike across town). Key neighborhoods for renters:

Overall, Chiang Mai rents are far lower than Bangkok’s. A city-center 1BR might be ~9,000–15,000 THB/month, rising to 15,000–25,000 in Nimman for similar size. Expats here cite the slower pace, nature, and community. The city’s robust digital infrastructure and coworking scene (as highlighted on CNXLocal) keep Chiang Mai strong among remote workers.

Phuket, Thailand’s largest island, has a fragmented set of neighborhoods. After Karon and Kata, the most expat-heavy areas are:

Phuket attracts retirees (especially Europeans) and digital nomads seeking beach life. Infrastructure (ISPs, hospitals) is good especially in north Phuket and Chalong. Traffic is usually light island-wide outside rush hours (no daily gridlock like Bangkok). A car or bike is essential for most commutes.

Pattaya, on the Gulf coast near Bangkok, is Thailand’s second major beach destination. Its expat profile is unique (notably many Russians/Chinese, and a large retiree population). Key areas:

Pattaya is relatively flat and compact – little traffic. It’s about a 2-hour drive to Bangkok. The presence of the Eastern Economic Corridor (EEC) and U-Tapao airport expansion aim to boost local investment. Pensioners (especially Russian) often rent for 10–20 years, while younger expats (IT, construction) may rent near offices. By some measures, Pattaya’s overall condo rent hovered ~29,922 THB in 2023.

Hua Hin (and nearby Cha-Am) is the prime royal beach town on the Malay Peninsula. This family-friendly resort attracts seasonal tourists and many permanent retirees (Thai and international, especially Brits). Notable zones:

Hua Hin’s pace is more relaxed. There are golf courses, royal palaces (Maruekhathaiyawan, Mrigadayavan), and an international airport coming (suvarnabhumi – Brahmarak Um Airport by 2024) improving access. The town has a large German and Scandinavian expat community. Healthcare (Hua Hin hospital) is basic; many serious cases travel to Bangkok. The lifestyle appeal is the seaside calm and “small city” feel.

Koh Samui, in the Gulf, is a large island with multiple distinct areas popular among expats and retirees (often replacing Phuket for some after 2020). According to local experts, major expat hubs are:

Koh Samui rents in general are comparable or slightly higher than Phuket for similar property, due to limited land. An average city 1BR condo can be around 15k–25k THB. The island’s appeal is year-round summer weather, a slow pace, and community of other foreigners. Its infrastructure has improved (international airport, 5G), though traffic jams can now occur in Chaweng during high season. For serious long-term relocators, Koh Samui (like Koh Phangan/Pha Ngan) is often chosen by retirees and digital creatives, drawn to the island lifestyle.

The table below compares typical monthly rent ranges (in THB) for 1-bedroom (1BR) and 2-bedroom (2BR) units in each city, from 2021 through 2025, with a conservative forecast for 2026. Price-per-square-meter (sqm) averages for mid-2020s are also shown (where known). These figures are citywide approximate ranges; actual rents vary by neighborhood, building age, and amenities. (Forecasts assume moderate growth ~5–10% annually after 2023.)

|

City / Unit |

2021 (THB/month) |

2022 |

2023 |

2024 |

2025 |

2026 (est.) |

Price/m² (THB) |

|

Bangkok (Condo) 1BR |

15,000–25,000 |

20,000–35,000 |

25,000–45,000 |

30,000–50,000 |

35,000–55,000 |

40,000–60,000 |

~566 |

|

Bangkok (Condo) 2BR |

25,000–40,000 |

30,000–50,000 |

40,000–70,000 |

45,000–80,000 |

50,000–90,000 |

55,000–100,000 |

~15,000–20,000 |

|

Chiang Mai 1BR |

8,000–12,000 |

10,000–16,000 |

12,000–18,000 |

14,000–22,000 |

16,000–24,000 |

18,000–26,000 |

~10,000–12,000 |

|

Chiang Mai 2BR |

12,000–18,000 |

15,000–24,000 |

18,000–28,000 |

20,000–32,000 |

22,000–36,000 |

25,000–40,000 |

~7,000–10,000 |

|

Phuket 1BR |

10,000–20,000 |

12,000–25,000 |

15,000–30,000 |

18,000–35,000 |

20,000–40,000 |

22,000–45,000 |

~13,000–15,000 |

|

Phuket 2BR |

20,000–35,000 |

25,000–45,000 |

30,000–50,000 |

35,000–60,000 |

40,000–70,000 |

45,000–80,000 |

~8,000–12,000 |

|

Pattaya 1BR |

8,000–15,000 |

10,000–20,000 |

15,000–25,000 |

18,000–30,000 |

20,000–35,000 |

22,000–40,000 |

~10,000–12,000 |

|

Pattaya 2BR |

15,000–25,000 |

20,000–30,000 |

25,000–40,000 |

30,000–45,000 |

35,000–50,000 |

40,000–55,000 |

~7,000–9,000 |

|

Hua Hin 1BR |

7,000–12,000 |

8,000–15,000 |

12,000–18,000 |

14,000–22,000 |

16,000–25,000 |

18,000–28,000 |

~9,000–10,000 |

|

Hua Hin 2BR |

12,000–20,000 |

15,000–25,000 |

18,000–30,000 |

20,000–35,000 |

25,000–40,000 |

28,000–45,000 |

~7,000–8,000 |

|

Koh Samui 1BR |

10,000–18,000 |

12,000–22,000 |

15,000–28,000 |

18,000–32,000 |

20,000–36,000 |

22,000–40,000 |

~11,000–13,000 |

|

Koh Samui 2BR |

18,000–30,000 |

22,000–35,000 |

25,000–40,000 |

30,000–45,000 |

35,000–50,000 |

40,000–60,000 |

~9,000–11,000 |

Note: These ranges are illustrative. Sources such as local property reports and listings indicate similar figures (e.g. a 1BR in Bangkok averaged ~563 USD in 2024). Price per sqm in Bangkok Grade-A condos is roughly THB 566 (mid-2024), with outlying suburbs much lower. Other cities have lower land values; e.g. Chiang Mai ~10–12k THB/sqm on average, Phuket ~13k, Pattaya ~10–12k, Hua Hin ~9k, Samui ~11k. Year-to-year changes reflect rising demand (forecast +5–10% annually).

Foreign renters in Thailand fall into clear segments, each with different budgets and motivations:

Overall, budget bands roughly are: low (<฿15k) for students and budget nomads; mid (฿15k–30k) for most expats/nomads; high (>฿30k) for executives and luxury-seekers. Negotiation: non-Thais often try to get rent slightly below asking (most landlords expect ~10% haggling). Professional landlords (owning ≥5 units) are bound by tenant-protection norms (e.g. must return deposit in 7 days), while private landlords wield more flexibility.

Thai rental contracts are typically simple written agreements (“สัญญาเช่า”). There is no special foreign-tenant law; Civil & Commercial Code governs leases (max 30-year lease terms). In practice, most leases are 1 year with a renewal option. A valid contract should list all parties, address, rent schedule, deposit, lease duration, utilities, maintenance, rules, and termination notice (usually 30 days).

Deposits and Advance Rent: Standard practice is 1–3 months’ rent as security deposit and 1 month’s rent in advance. For example, a Thai agent notes: a 15,000 THB/month rental often requires a 30,000 THB deposit + 15,000 THB advance. Deposit is usually returned within a week after lease end, minus any unpaid bills or damage. Landlords cannot legally keep the deposit arbitrarily: only for unpaid rent, unpaid utilities, or damages beyond normal wear. (If a tenant breaks the lease early without a “diplomatic clause,” the deposit is typically forfeited.)

Rent Increases: Rents are freely negotiated. Adjustments are typically done only at renewal. Landlords should give at least 30 days’ notice for any rent hike, usually aligned to the new lease term. A sudden mid-contract increase is uncommon and requires mutual agreement.

Tenant Protections: Thailand’s tenant laws lean landlord-friendly, but recent reforms have bolstered some tenant rights for professional landlords. These include: utilities charged only at cost, deposits returned promptly (within 7 days), landlord must give notice before inspections, and clear rules for evictions and late-payments. Unlawful eviction is prohibited; even delinquent tenants get a negotiation chance before eviction. However, smaller landlords (who rent fewer than 5 units) are not strictly bound by these practices, though many abide anyway.

Termination and Disputes: Either party can end a lease at term-end with 30 days’ notice. Tenants have no rent-withholding right if the landlord delays repairs; their remedy is contract termination if the place is uninhabitable. In disputes, parties usually negotiate; otherwise civil court or police eviction can be invoked after final notice expiration. International renters have occasionally successfully used Thai courts to enforce contracts, but legal proceedings are slow and costly.

Contract Clauses: Watch out for unfair clauses. For example, Thai law prohibits clauses that keep extra deposit beyond 3 months’ rent or confiscate advance rent. New regulations forbid landlords from making arbitrary rules on deposit and advance rent beyond the statutory norms. Ensure the lease is bilingual (Thai/English) if possible, and explicitly outline negotiation/breach terms. It is wise to include a “diplomatic clause” if your visa is tied to leaving (though usually applies to Western embassies).

In sum, Thai rentals operate on an honor system shaped by the contract. Foreign renters should be aware that landlords hold significant power (they can evict via police once term ends, and the “landlord” identity can be a registered business or an individual). Using a reputable rental agency or lawyer to review a contract is recommended, especially for large deposits or long leases.

Moving into a rental in Thailand involves several upfront costs:

Furnished vs. Unfurnished: Fully furnished (with AC, fridge, bed, kitchen etc.) is standard in expat rentals. A 2BR furnished condo might cost 10–20% more than unfurnished. Unfurnished places require tenants to bring/buy furniture. Sometimes landlords require a higher deposit for furnished units due to potential damage.

Scams and Red Flags: Foreign renters should vigilantly verify listings. Common rental scams include: bogus “agents” taking money for a nonexistent property, duplicate listings (same unit rented twice), or landlords asking for money outside Thailand (risking wire-fraud). Always inspect the property in person before paying anything, verify that the person renting it is the legal owner or agent (request title deed or letter of authorization), and never transfer money via non-traceable methods. Wise counsel suggests checking IDs and not just trusting overly cheap deals. If using a property website, cross-check the listed price with market averages – if it’s hundreds of dollars below, treat with suspicion. For example, Wise warns to always visit and verify ownership documents before paying any deposit. Engaging a reputable relocation service or English-speaking landlord can mitigate risks.

Long-term leases (1–3 years) are most common for expats. Multi-year deals often yield slightly lower rent per month. Shorter leases (<6 months) are rare except with premium serviced apartments; most legal leases require at least 30-day notice to terminate. Some foreigners try to perpetually renew 30-day tourist visas to extend stays, but this is risky and not a sustainable strategy for housing.

Rent Payment: Paid monthly, usually by cash or bank transfer. Landlords may prefer Thai bank transfer for records. Always get a receipt for each payment.

Utilities: Utilities (water, electricity, gas) are usually tenant’s responsibility, prorated by meter. Electricity in apartments/houses is billed by meter; Thai apartments can charge as high as 6–8 THB per kWh. Internet/cable/phone are tenant expenses – many landlords even choose and install them. Wise advises utilities must be charged at cost (no surcharges) for professional landlords.

Pet Policies: Many condos ban pets, but some allow small ones. There’s no law preventing pet ownership. Clarify with the lease; if a pet is sneaking in, risk fines or eviction.

Maintenance: Minor fixes (lightbulbs, AC filters) often fall on tenants; major repairs (plumbing, structural) are landlord’s duty. Don’t stop paying rent if something needs repair; instead, give notice and request remedy. Only if property becomes uninhabitable can you legally break the lease.

Subletting: Generally, subletting requires landlord’s permission and is often prohibited explicitly. Even if you have a diplomatic clause (letting you break lease for certain visa exits), subletting without consent can void your lease.

Renting in Thailand can involve several hidden expenses and risks:

Yields and Investment: Thailand’s gross rental yields (annual rent as % of property price) average around 6.1% nationally. Central Bangkok condos yield lower (~4–5%) due to high values, while outskirts and provinces offer higher yields (~6–7%). For example, Samut Prakan (BKK outskirts) averages 7.07%, Nonthaburi ~6.43%. Gulf-coast resorts (Phuket ~5.9%) and Pattaya/Chonburi (~5.4%) yield moderately. Yields held up decently through 2020–22 due to price dips, making rental property attractive to some investors despite lockdowns.

Seasonality: Demand is highly seasonal. High season (Nov–Feb) sees rents and occupancy peak, especially in Phuket and Samui. Low season (May–Oct) often gives leverage to negotiate discounts or short-term lets. In Bangkok/Chiang Mai, seasonality is milder, but still weekends/festivals (Songkran, New Year) cause spikes in short-term demand. Landlords often time lease renewals for late November to lock in high-season rates.

COVID and Remote Work Influence: The rise of remote work is reshaping the market. Programs like Thailand’s DTV visa (2024) encourage nomads to rent in Thailand for up to 5-year stays. Co-living spaces with flexible leases and communal work amenities are growing fast. Some developers convert unsold condo units to rent to capture this trend. As noted by industry experts, digital nomads are “rewriting the rulebook” – demand has spiked for furnished, internet-ready units in lifestyle areas. This has tightened the market for affordable centrally-located units in Bangkok and resort islands. It also means landlords might favor shorter, fully-furnished leases to cater to nomads.

Foreign Occupancy Patterns: Before COVID, foreign tenants (excl. Thais) constituted roughly one-third of Thailand’s urban rental market. During border closures in 2020–21, most rentals went to domestic tenants or sat vacant (with owners staying put). Post-reopening, expat occupancy is climbing: in 2023–24, 40+ million tourists visited, many of whom transition some to long-term stays. Anecdotal reports from agencies indicate rising interest from Europeans and Australians for Phuket/Hua Hin after 2022. However, Southeast Asian renters (Chinese, Indian, Singaporean) have also returned strongly. The Occupancy for foreign-targeted rentals in tourist cities likely reached ~80-90% in high season of 2024, whereas low season may dip to 50-60%.

2026+ Outlook: Infrastructure projects will influence future rental hotspots. The MRT Orange and Pink lines (Bangkok) and airport rail link by 2027 will open new corridors in BKK suburbs, likely boosting rents there. The Eastern Economic Corridor (EEC) improvements (U-Tapao Airport, hi-speed rail) could push demand around Pattaya. In Chiang Mai, the proposed highway to Laos could raise land values. Beach destinations may see more regulated development: Koh Samui and Phuket are expanding ferries and roads. Overall, analysts forecast Thailand’s economy to grow ~2.9% in 2025, supporting real estate. If interest rates stay moderate and tourism fully recovers, moderate rent increases (5-10% per year) are likely through 2026. Areas near new mass transit stations or airports will be especially sought-after.

For any renter in Thailand, the following practical advice can help ensure a smooth experience:

Infrastructure and Policy: Several projects will shape rentals in coming years. In Bangkok, expansions of the MRT (Orange, Pink lines by 2027) will open new residential hubs (Hua Mak, Min Buri). The new Bangkok-to-Pattaya high-speed rail (target ~2030) may spur mid-priced developments along the route. The EEC (via U-Tapao airport expansion) may turn the Chonburi coastline into a mini-bustle, affecting Pattaya rents. Southern development projects (bridge projects to Phuket, Samui’s airport upgrade) are slower but could eventually boost demand.

Zoning and Urban Plans: Bangkok’s 2023 master plan encourages transit-oriented housing; strict zoning may limit foreign condo development in certain areas, possibly keeping rents high. Chiang Mai’s 2030 plan includes a “green city” park rail (monorail) – areas along that line could see rising rental demand.

Emerging Hotspots: Some smaller cities may rise in rental interest. For example, Khon Kaen in the north (a new international airport) and Pattani/Hat Yai in the south could draw expats in future, though currently very small foreign communities. More realistically, Chiang Rai (northern border town) is noted for very cheap rent and might attract retirees. The islands of Koh Phangan/Koh Tao have strong nomad enclaves that spill into their rental markets.

Economic Factors: With Thai household debt high and lending restrictions intact, home buying is tough for locals, keeping rental demand stable. If interest rates remain low globally, foreigners might invest in Thai property for rental yield – creating more rental stock. Conversely, if another pandemic or travel restrictions recur, the market would again shift favoring locals (as in 2020-21).

Conclusion: For the foreseeable future, Thailand’s rental market looks balanced to growing. For foreign long-stayers, it means a largely stable market with moderate price growth and improving options (more new condos and co-living projects), but also a market that rewards savvy tenants who understand local norms. This guide has detailed the landscape: from district specifics to legal tips, from price data to personal profiles – arming you with the knowledge to find your ideal Thai rental home.