Buying Property in Thailand: A Comprehensive Guide for Foreign Investors

Foreign buyers are driving renewed interest in Thailand’s real estate market, attracted by the country’s vibrant culture, tropical climate, and strong investment fundamentals. In recent years Thailand has seen steady economic recovery, a tourism boom, and government support for infrastructure – all of which have underpinned modest but reliable property price growth and rental demand. For foreign investors – from digital nomads and retirees to high-net-worth individuals – Thailand offers a range of purchase options, from centrally located Bangkok condos to beachfront villas on Phuket and Samui. This guide provides a detailed overview of Thailand’s property market (2021–2025 trends and forecasts), the types of properties available, key locations, legal rules, pricing, yields, taxes, and smart investment strategies. It is written for an international audience interested in buying property in Thailand, offering clear, investor-focused insights and data-backed analysis.

Foreign demand has become a key support for the market. According to industry data, condo sales to non-Thais increased in 2024 despite slower local sales, with over 11,000 units (3.1% more than a year earlier) sold to foreigners in Q1–Q3 2024. In fact, foreign buyers now account for roughly 13–15% of all condominium transfers. The main sources include China, Myanmar, and Europe. Thailand’s appeal to retirees, digital nomads, and global investors – coupled with large tourism inflows – is expected to keep supporting the market as the economy grows. Macroeconomic forecasts foresee Thailand’s GDP growing around 3–4% in 2024–25, which, along with infrastructure projects like new metro lines and the Eastern Economic Corridor, should drive moderate property demand. Overall, residential prices have been rising gradually, roughly in the low-single-digit range annually, and transactions volumes have rebounded (e.g. a recent 15% YoY jump). In short, for foreign investors looking to buy property in Thailand, the current market offers stability, affordability (relative to Western cities), and continued growth potential in key segments.

1. Overview of Thailand’s Real Estate Market

Thailand’s real estate market is recovering from the Covid-19 era and entering a growth phase fueled by tourism and foreign capital. The economy is strengthening, with GDP growth around 3.4% projected for 2024. Infrastructure development – new metro lines, high-speed rail corridors, airport expansions – is making urban and resort areas more accessible, which boosts property demand in both cities and secondary towns. By 2024, tourism has rebounded strongly (tourist arrivals up over 150% in 2023 vs 2022), driving demand for holiday homes and rentals in hotspots like Phuket, Pattaya, Chiang Mai and Koh Samui. At the same time, a growing expat population and lifestyle migration (“work from anywhere” era) has added steady demand for urban apartments and housing.

- Resilient foreign demand: Demand from overseas buyers has remained a bright spot. Reuters reports that sales to Myanmar nationals (already the second-largest foreign buyer group after Chinese) more than tripled in early 2024 vs. 2023, even as purchases by Russian and Chinese investors eased. This indicates how geopolitical factors can shift buyer flows into Thailand. Overall, foreign buyers have made up about 13–15% of condo transfers. The government is also considering measures to attract even more foreign investment (for example, proposals to extend condo ownership quotas beyond 49% and longer lease terms).

- Steady price growth: Real estate prices in major areas are rising at a modest pace. Nationwide house price growth was about +2–3% YoY in late 2024. Detached houses and townhouses have seen slightly stronger increases (~2.5–3.5% per year) while condominium prices are rising a bit more slowly (around 2–3% annually). Market data suggest 2024 ended with low-single-digit gains and analysts forecast similar growth of roughly 2–3% per year in 2025–26, assuming continued economic expansion.

- Shift to low-rise housing: A pandemic-driven trend toward bigger living spaces has favored single-family homes and townhouses. For example, over 60% of recent presales by major developers like Sansiri were low-rise projects rather than high-rise condos. Many families and mid-income buyers are opting for larger, suburban homes (often still within commuting distance of Bangkok thanks to new transit lines). In some markets (e.g. Hua Hin and Chiang Mai), affordable detached houses on larger lots are also in high demand for retirees and remote workers.

- Challenges and risks: On the downside, rising interest rates and household debt could temper buying power. A residue of unsold inventory (from years of new launches) means sellers may need to discount or slow new project rollouts. Political shifts can also introduce uncertainty – investors will watch the new government’s stance on foreign investment and property regulations. Nevertheless, with proactive policies (like the Eastern Economic Corridor incentives) and infrastructure spending, the consensus is that the market will expand gradually rather than bubble.

In summary, Thailand’s property market today is characterized by stable growth driven by solid fundamentals. Foreign investors will find abundant opportunities from city apartments to resort villas, in a market where prices remain attractive by global standards and demand is expected to stay supported by tourism and expat living.

2. Types of Properties for Sale in Thailand

Foreign buyers can choose from the full spectrum of Thai residential real estate. The main categories include condominiums (apartments), detached houses or villas, townhouses, and land. Each has its own appeal, price point, and ownership rules:

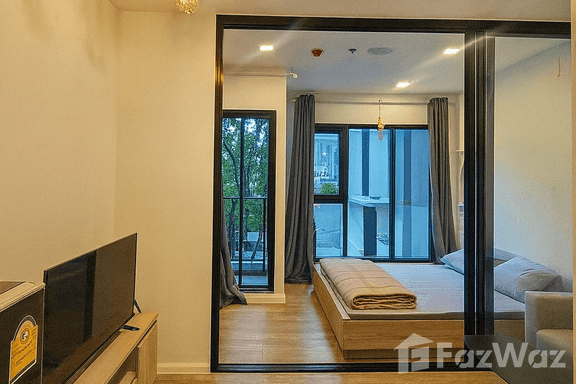

- Condominiums (condos): The condo market is the primary vehicle for foreign ownership. Under Thai law, foreigners may directly own condo units freehold, subject to a 49% foreign-ownership quota in any building. That means up to 49% of the floorspace (by area) in a condo project can be held by non-Thai individuals or companies. If the foreign quota is full, buyers can still lease or take other indirect routes (but outright purchase isn’t permitted beyond 49%). Because of the ease of ownership, condos are popular with expatriates and investors. Benefits include clear titles, full title deeds, and the ability to rent out the unit to tourists or long-term tenants. Maintenance and management tend to be streamlined through building management offices. Condos are available at all price levels – from small low-rise apartments and new high-rises (suites, studios, 1-3BR units) to super-luxury skyscrapers. Foreign buyers often target high-quality condos in city centers (Bangkok, Chiang Mai), resort towns (Phuket, Hua Hin, Pattaya), or even project developments on islands (Samui, Phuket). Because condo titles allow 100% ownership, many foreigners regard condos as the safest and simplest investment type.

- Detached houses and villas: Single-family houses (often referred to as “villas” in the Thai market) come in many forms: suburban 2-3 bedroom houses, luxury beachfront villas, or estate-style properties. These typically sit on private land and are freehold assets. However, Thai law prohibits foreigners from owning land outright. This means a foreigner cannot directly hold title to a plot of land beneath a house or villa. The usual strategy is to structure purchases via a long-term leasehold. For example, a common approach is to sign a 30-year renewable lease on the land, giving control of the land for three decades (and potentially renewing twice for up to 90 years). Many resort projects and private sellers offer standard 30+30+30 lease terms. The house or villa itself (the building) can sometimes be owned via other legal structures (like a usufruct or Thai majority company), but the land remains leased. As a result, buying a villa as a foreigner can be more complex than a condo, but it remains popular among high-net-worth individuals seeking privacy, luxury, or bespoke property. Beachfront villas or hillside estates in Phuket, Koh Samui, or Pattaya can command premium prices (often in the millions of dollars) but also offer strong rental income potential in tourist markets.

- Townhouses: These are typically narrow, attached homes in suburban or urban developments. Think of them as smaller, multi-story houses sharing walls with neighbors. Townhouses in gated communities are common in Bangkok’s outskirts and in cities like Chiang Mai or Hua Hin. Thai buyers often use them for family residences, and they can be more affordable than detached houses. Foreigners cannot own the land under a Thai-style single-title townhouse, so the same leasehold approach applies – often the development owner will lease plots on a per-unit basis. In terms of pricing, mid-range townhouses in Bangkok suburbs may sell for roughly THB 5–8 million (≈$140k–$220k), with luxury or large units going higher. Townhouse ownership still allows decent returns through rental to Thai families or small businesses, though yields tend to be lower than city-center condos.

- Land: Purchasing undeveloped land is generally not feasible for foreigners except by marriage or company (restricted). Most expat investors avoid raw land purchases because of the ownership ban. Instead, they acquire land exposure through leaseholds (as part of villa/house deals) or by owning a building on leased land (e.g. a factory or warehouse structure, though this is rare for residential buyers). Even where land could be leased, investors must carefully study lease terms and renewal rights. It’s also important to note that Thailand has introduced an annual land and building tax (based on a percentage of assessed value), which applies to all property types. In practice, foreigners focus on constructed properties (condos, houses) rather than raw land.

Key takeaway: For foreign buyers, condominiums offer the cleanest, most straightforward ownership with freehold title (though capped at 49% of any building). Villas, houses, and townhouses can provide more space and privacy but must be held on leaseholds or through special structures. Each property type serves different needs: condos for ease and rental demand, houses/villas for luxury or lifestyle, and townhouses for affordable suburban living.

3. Best Locations to Buy Property in Thailand

Location is crucial in real estate. In Thailand, certain cities and regions stand out for their lifestyle appeal, investment potential, and popularity with foreigners. Here we highlight the top destinations:

Bangkok

Bangkok is Thailand’s bustling capital and the country’s economic heart. It offers world-class amenities (shopping malls, hospitals, schools, entertainment) and serves as a business hub. For foreign buyers, Bangkok means urban condos and serviced apartments. Prime districts like Sukhumvit (Thonglor, Asoke), Silom, Sathorn, and Riverside command the highest prices. Average condo prices in central Bangkok are around THB 140,000–150,000 per sqm as of 2025, with top luxury projects reaching THB 200,000–236,000+ per sqm. For perspective, a two-bedroom condominium in central Bangkok averages roughly USD 303,000 (≈THB 11 million). Bangkok yields for condos are typically around 4–6% gross, depending on location and unit size.

Foreigners here include international executives, diplomats, young professionals, and investors. Bangkok is especially attractive to those valuing city life: coworking spaces for digital nomads, international schools for expat families, and hospitals for retirees. New mass-transit expansions (subway and skytrain lines) are also making new neighborhoods more accessible, so suburban districts like Bang Na, On Nut, and nonthaburi now have more budget-friendly options (condos around THB 80,000–120,000/sqm) that still rent easily to Thai tenants or expats. Prices in Bangkok grew moderately through 2024 (for example, 1BR condos saw ~3–6% annual gains). Looking ahead, Bangkok is expected to remain a strong market; global investors see Thai city condos as offering high quality for the price compared to other Asian capitals.

Phuket

Thailand’s largest island, Phuket, is a top foreign investment hotspot due to its beaches, resorts, and tourism infrastructure. The market here is heavily driven by vacation rentals and holiday home demand. Average luxury condominium prices range roughly THB 150,000–180,000 per sqm. Two-bedroom condos go for about USD 296,000 (THB 11 million) on average. Detached villas command higher prices: median villa prices in Phuket are around THB 19.2 million (≈$560k), with prime beachfront estates far above that.

Rental yields in Phuket are competitive: gross yields ~5.9% for apartments and ~5–7% for villas, reflecting strong tourist demand. During 2024, Phuket saw a surge of new villa projects (over THB 31 billion value in H1 2024), signaling HNW interest. For a foreign buyer, popular areas include Patong (nightlife), Laguna/Cherng Talay (expat community), Kamala/Kata (family-friendly), and the upscale Surin/ Layan zones. Phuket appeals to retirees and investors looking for both vacation use and rentals. Notably, in 2024 a large share of condo purchases by foreigners in Phuket came from China and Europe. The market’s outlook is positive – tourism is back at pre-pandemic levels (152% increase in 2023) and infrastructure (new airport, roads) is improving. Case study: Phuket villa development prices rose ~5–7% year-on-year in 2024, reflecting record demand.

Pattaya (Chonburi)

Pattaya, on the eastern Gulf coast near Bangkok, is another major expat draw. Long known as a resort town, it offers relatively affordable condos and a large expat community (especially Russians and Europeans). Condo prices here are lower than Bangkok or Phuket. For example, two-bedroom apartments average about THB 89,000–178,000 per sqm, and two-bed units average about USD 178,000. Luxury seaside villas in Pattaya tend to cost around USD 150k–250k. Rental yields in Pattaya are somewhat lower (around 5.4% gross on condos), but demand remains steady thanks to tourism and a robust long-stay market (the city is popular with retirees and winterers).

Buyers choose Pattaya for its beach lifestyle and lower prices. The city has good hospitals, international schools, and a new commercial center (Pattaya City). High-rise condo towers, many offering hotel-style services, abound in Jomtien and North Pattaya. Some foreign investors are even buying villas on nearby islands like Koh Larn. Looking ahead, Pattaya benefits from infrastructure (new highway to Bangkok, EEC developments in Chonburi) and may see moderate price appreciation. For example, prime land along Pattaya Beach Road is selling for around THB 220,000 per sq.wah (≈฿55,000/sqm), reflecting its growth.

Hua Hin

Hua Hin, a coastal town on the Gulf of Thailand about 200 km southwest of Bangkok, has emerged as a top retirement and second-home destination. It offers beach living plus urban conveniences (with less bustle than Bangkok or Pattaya). Properties in Hua Hin cover a range: from condos and gated house communities to luxury beachfront estates. As of mid-2025, the average condo price in Hua Hin is about THB 87,400 per sqm (≈$4,200/sqm), while the average house price is around THB 38,900 per sqm. Frontline luxury condo projects can command up to THB 254,000/sqm.

The Hua Hin market has been strong: analysts note 40% of new condo sales are to foreign buyers (many Japanese, Europeans, and Chinese). Sales volumes jumped ~45% in 2024, and prices are rising about 3–7% annually. Rental yields are reported around 5–7%. Key buyer groups include retirees (drawn by the low-key vibe and golf courses) and digital nomads (attracted by good internet, co-working spaces, and wellness facilities). Areas like Khao Takiab and beachfront developments enjoy the fastest growth (7–10% annual price increases in 2025). Compared to Phuket, Hua Hin offers more modest prices for seaside real estate, making it a very popular value-for-money choice for foreigners.

Chiang Mai

Chiang Mai is the cultural and economic hub of northern Thailand. It appeals to buyers who value a laid-back lifestyle, lower cost of living, and scenic mountain surroundings. The city has a large expat and digital nomad community. Real estate options include a mix of low-rise condos, townhouses, and detached houses. Average condo prices in Chiang Mai are much lower than Bangkok – around THB 60,000–80,000 per sqm (about $1,820–$2,430/sqm). A one-bedroom condo of 60 sqm costs roughly THB 3.6–4.8 million (about $100k–$130k). Houses are cheaper still: the average house price/sqm is only about THB 25,000.

Despite lower prices, rental yields in Chiang Mai can be attractive. Long-term rental yields average around 5% (for centrally located condos, often to students or expats). Short-term (Airbnb) yields may be higher if managed well. Key neighborhoods include Nimmanhaemin (trendy expat area), Old City, and areas near international schools. Risk factors include seasonal rental demand (Chiang Mai tourism spikes in the cool season) and slower overall price appreciation compared to Bangkok/Phuket. Still, Chiang Mai remains a top choice for first-time foreign investors and retirees looking for affordability. Importantly, all foreign condo purchases in Chiang Mai count against the same 49% quota per building.

Koh Samui

Koh Samui is Thailand’s second-largest island after Phuket and a world-renowned tourist destination. Its property market is villa-driven: waterfront and hillside homes overlooking the Gulf dominate. Average price levels are high due to scarcity of land. As of 2025, the average built-up house price is about THB 59,250 per sqm. Condominiums, often smaller developments, average around THB 50,000–70,000 per sqm. Luxury beachfront villas (3–5 bedroom) typically range from 55 million THB upwards.

Koh Samui’s investment draw is strong yields: island villas can earn 7–10% gross rental yields, thanks to year-round tourism. The market has been heating up; analysts project 5–7% annual growth through 2030. Areas like Bophut (Fisherman’s Village) and Choeng Mon have seen especially hot demand. A case in point: Koh Samui’s feature in HBO’s “White Lotus” has spurred a tourism surge, pushing villa day rates sky-high. For a foreign buyer, Samui offers the island lifestyle – but be mindful of connectivity (Samui has a small airport) and higher price/competition. Still, its yields and long-term prospects have made it a new favorite among affluent investors.

Summary of Key Locations: In all these destinations, certain themes recur: Thai coastal and resort cities rely heavily on tourism and foreigners, offering high yields but also seasonal risk; Bangkok is driven by domestic demand and international business; Chiang Mai by digital nomads and expats; Hua Hin by retirees. Price points vary widely – Bangkok condos might be 3–4 times more expensive per sqm than Chiang Mai’s, and Phuket villas far exceed Hua Hin homes in absolute price. When choosing a location, foreign buyers should consider lifestyle fit (climate, amenities) and investment goals (rental market vs. capital gain). All these areas have active property markets with English-language services and expatriate networks to help foreign investors feel at home.

4. Legal Framework for Foreign Ownership

Understanding the legal rules is critical. Thailand’s property laws are unique, and the key points for foreigners are:

- Condominiums: The Thai Condominium Act allows foreign individuals and companies to own condo units freehold. However, the entire building has a foreign-ownership cap of 49% by usable area. In practice this means when you buy a condo unit, the title deed is in your name as full owner, but only if that building’s foreign quota is not yet exhausted. You should verify that the project is less than 49% foreign-owned before purchase. Importantly, foreigners may buy multiple condos as long as each building does not exceed the limit. Otherwise, if the foreign quota is full, developers often offer 30-year leases instead.

- Land and Houses: Under the Land Code, no foreigner may directly own land. This includes farm plots, house lots, or any ground area. However, foreigners are allowed to lease land long-term. A typical structure is a 30-year lease agreement, recognized by the Land Department as a secure right. These leases can be written to allow two 30-year renewals (for a total of up to 90 years), though renewals beyond the first must be agreed with the landowner. In practice, many villa and house purchases by foreigners involve a 30-year lease (with renewal rights) on the land, combined with foreign ownership of the building (e.g. via Thai company shares or usufructs). For example, you could lease the land to build a house on it – the house itself can be structured as a owned building.

- Thai Company Ownership: Some foreigners form a Thai majority-owned company (49% foreign stake) to hold land. Legally, this is allowed but it carries risk: Immigration and BOI officials take a strict view to ensure the company is a genuine operating entity, not a sham for land holding. Recently, authorities have warned against such “back-door” land purchases. In general, company ownership is considered only when a foreigner is a very large investor (e.g. factory) and meets certain economic criteria. For most real estate buyers, the condominium and leasehold routes are far simpler.

- Usufructs and Superficies: Thai law provides some limited rights where a foreigner can register a usufruct (right to use property) on land for life or co-own building on land by registering a superficies (building lease of 30 years). These are more technical tools, often used in hospitality ventures. They require registration with the Land Department to be valid.

In summary, the safe approach for buying a home or investment property is usually to purchase a condo unit (freehold) or to arrange a long-term lease for a house/villa. Always engage a qualified Thai lawyer or property agent to ensure compliance. Note also that condo purchases by foreigners must be funded by “foreign currency” (not from a Thai-baht bank account) as declared to the Bank of Thailand. These controls are routine and require a Foreign Exchange Transaction Form for each transfer, but they are standard procedure and not overly burdensome.

5. Property Pricing Trends (2021–2025) and 2026+ Forecasts

2021–2023 – The Post-Covid Reset: In the immediate aftermath of the pandemic, Thailand’s property market saw mixed effects. In 2020 and early 2021, travel bans and economic slowdown caused a temporary dip in prices and transactions. However, by late 2021 demand began to recover, especially as domestic Thai buyers returned and property developers reduced discounts to stabilize prices. The shift to low-rise housing became prominent in 2021 and 2022, as families sought more space. This meant suburbs and secondary cities gained share.

2022–2024 – Stable Growth: As Thailand reopened, tourism surged (reaching 27 million arrivals in 2023). This rekindled demand particularly for condos in resort areas and short-term rentals. Overall, residential prices increased gradually. According to market reports, national house price indices rose around 2–3% per year from 2022 through 2024. For example, in Q4 2024 Thailand’s single-detached house prices were +2.55% YoY and townhouse +3.53% YoY, while Bangkok condominium prices grew about +2.46% YoY. These are modest gains compared to the double-digit rises in some other Asian cities, reflecting both demand and cautious supply growth.

Certain segments outperformed: suburban and holiday-home markets (e.g. Hua Hin, Chiang Mai, Koh Samui) saw higher appreciation due to limited new supply and rising foreign interest. For instance, Hua Hin condo values were up ~5–7% annualized by mid-2025. By contrast, ultra-high-end luxury in Bangkok moved more slowly, since buyers became price-sensitive.

2025 Forecast: Analysts now project continued but moderate appreciation (roughly 2–3% annually) in 2025 and 2026. A key reason is that while demand (tourism, investment) is up, supply of new condos remains constrained (many developers are keeping inventory low, focusing on affordable segments). The Real Estate Information Center (REIC) expects a slight uptick in unit sales in 2025, and consultants like KKP foresee slow growth without new stimulus. The government has introduced incentives (e.g. lowering transfer fees for properties under THB 7 million until 2026) which should help mid-market sales. However, risks include rising interest rates and household debt levels, which could cap price gains.

2026+ Outlook: Longer-term, Thailand’s property outlook is cautiously optimistic. Key drivers include: tourism recovery (projected to reach 40 million visitors by 2027 if current trends continue), foreign investment policies (new visas for wealthy and digital nomads aim to attract affluent long-stayers), and infrastructure (new airport in Chiang Mai, high-speed rail, EEC). These should support higher property values over time. Some forecasters believe prime areas could see accelerating growth if foreign quotas were relaxed. However, prices are unlikely to spike dramatically; Thailand is seen more as a stable, value-oriented market. In summary, foreigners entering now can expect continued steady appreciation and should plan for holding periods of at least 5–7 years to capture gains, while enjoying rental income or lifestyle benefits in the interim.

6. Average Property Prices by Type and Location

Foreign buyers often compare prices across cities and property types to target the best value. Below are illustrative averages and ranges (in Thai baht) for condos, villas (houses), townhouses, and some land values in key locations. All figures are approximate market values as of 2024–2025 (price per unit or per square meter as noted).

|

City / Location

|

Condominium<br>(THB per sqm)

|

Townhouse<br>(price per unit)

|

House/Villa<br>(price per unit or sqm)

|

Land (baht per sqm)

|

|

Bangkok (CBD)

|

140,000–236,000

|

5–8 million (BKK suburban)

(outer BKK 2–4M)

|

Villa/houses: 15M+ (luxury)

|

~500,000–1,000,000 (central areas)

|

|

Phuket

|

150,000–180,000

|

8–15 million

|

12–25 million (detached)

|

~115,000 (Bang Tao / Cherng Talay rental market)

|

|

Pattaya (Chonburi)

|

69,000–178,000

|

(few mid-range; similar to BKK)

|

150k–250k USD (villas)

|

~220,000 (Pattaya Beach Rd)

|

|

Chiang Mai

|

60,000–80,000

|

3–6 million

|

7–12 million (houses)

|

60,000–90,000 (inner city); ~250,000/wa (Tha Phae Rd)

|

|

Hua Hin

|

~87,400

|

~3–5 million (small houses)

|

3.9–4.0 million (average house/sqm)

|

150,000–230,000 (prime beachfront per wa)

|

|

Koh Samui

|

50,000–70,000

|

5–10 million (inland villa)

|

15–80+ million (beachfront)

|

~60,000 (houses avg) (farmland less)

|

Bangkok: In the central business districts like Sukhumvit and Silom, luxury 2–3BR condo prices run in the 200k–236k THB/sqm range. For example, a new condo in Thonglor may be ~฿8–15 million (approx 200k sqm) for a 40–80 sqm unit. Townhouses in suburbs (e.g. Bang Na, Pattanakarn) typically cost 5–8 million THB; large detached homes in affluent zones (Sathorn, Ekkamai) are often 15+ million THB. Land plots in Bangkok’s most expensive areas (Siam-Silom) can exceed 3.8 million baht per sq.wah (i.e. ~฿962,500 per sqm!). By contrast, outer Bangkok land is much cheaper (often <฿50,000 per sqm).- Phuket: Condo prices average about 150k–180k THB/sqm. Newer projects around Laguna area, for instance, list 1BR at ~฿4M (20–40 sqm). Townhouses and family homes in Phuket’s inland areas may be 8–15 million THB. Detached houses (two-story, 3–4BR) in mid-market villages often run THB 12–25 million. Beachfront land is very expensive (sometimes >฿200,000/sqm on Cherng Talay). For reference, Villa Finder data shows a median Phuket villa at 19.2M THB (115,000 THB/sqm).

- Pattaya: Average condo asking prices in Pattaya range from ~69,000 to 178,000 THB/sqm, depending on proximity to beaches and amenities. Townhouses are less common but are priced similarly to Bangkok suburbs (around ฿5–8M). Mid-range seaside villas (3BR) often cost USD 150k–250k (approx 5–8M THB). The land price per sq.wah on Pattaya Beach Road is about 220k THB.

- Chiang Mai: One of Thailand’s most affordable major cities. Condos average ~฿60k–80k per sqm (a 60 sqm, 1BR condo might cost THB 3.5–4.8M). Townhouses go for around 3–6 million THB in good suburbs. A larger house (4BR) in a family neighborhood can be ~฿8–12M. By international standards this is low: many Western buyers consider Chiang Mai a bargain. The highest-priced land (city center) is about 250k/wa (฿62.5k/sqm).

- Hua Hin: As of 2025, the average condo price in Hua Hin is ~฿87,400/sqm. Smaller 1BR condos might cost ~฿3–5M. Village-style houses average ฿39,000/sqm. Luxury beachfront condos command much more (฿150k–254k/sqm). Land in top areas (Khao Takiab) can go for ฿50–100 million per rai (฿125,000–฿250,000/sqm).

- Koh Samui: Villa land and homes dominate. Average built-house price is ~฿59,250/sqm (a small house might sell for ฿5–10M). Condos sell around 50k–70k/sqm. High-end villas range from ฿15M to ฿80M+ depending on size and location. Tourists create strong demand, so prime beachfront plots (e.g. Bophut, Choeng Mon) go well above ฿150,000/sqm in practice.

In table form, comparing cities and property types:

|

Property Type

|

Bangkok (CBD)

|

Phuket

|

Pattaya (Chonburi)

|

Chiang Mai

|

Hua Hin

|

Koh Samui

|

|

Condo Avg Price

|

฿140k–236k/sqm

|

฿150k–180k/sqm

|

฿69k–178k/sqm

|

฿60k–80k/sqm

|

~฿87k/sqm

|

฿50k–70k/sqm

|

|

Condo 2BR (USD)

|

$303k

|

$296k

|

$178k

|

$155k

|

(not available)

|

(not available)

|

|

Townhouse

|

฿5–8M (outer BKK ฿2–4M)

|

฿8–15M

|

฿~5–8M

|

฿3–6M

|

฿3–5M

|

N/A

|

|

Villa/House

|

≥฿15M (luxury)

|

฿12–25M

|

$150k–250k (฿4.5–7.5M)

|

฿7–12M

|

(Detached homes) ฿???M (avg ฿39k/sqm)

|

฿15–80M+

|

|

Land (sq.m.)

|

Up to ~฿1,000,000 (prime)

|

฿ ~200k (beach areas)

|

~฿55k

|

฿62.5k (Tha Pae Road)

|

฿125k–254k (beachfront)

|

฿59k (island avg)

|

Notes: Prices vary by neighborhood, project quality, and view. A newer luxury condo in Bangkok CBD easily exceeds listed ranges; an older one in outskirts is well below. Always refer to current listings for the most accurate pricing.

7. Rental Yields and ROI Analysis by Location and Property Type

One of the main attractions for investors is rental income. We analyze gross rental yields (annual rent ÷ purchase price) for different locations and property types, plus considerations for ROI.

- National average yield (~6.2% gross): According to market data, the average gross rental yield in Thailand’s residential market is about 6.17% (as of Q1 2025). “Gross” means before expenses (taxes, maintenance, vacancy). Net yields (after costs) will be 1.5–2 percentage points lower. Variation by city is significant.

- Bangkok yields (~4–6%): In central Bangkok, prime condos yield around 4–6% gross. For example, in Watthana and Khlong Toei areas, 1-bedroom condos fetched about 5.3–6.1% yields. Suburban spots (Nonthaburi, Samut Prakan) show slightly higher yields (6–8%) due to lower prices. For larger condos (2–3BR), Bangkok yields generally dip into the mid-4% range. Overall, Bangkok’s yield often hovers around 5.0–5.5% for good properties. ROI also comes from capital appreciation; Bangkok condos saw ~3.4–7% price growth in 2024. Thus a well-located Bangkok condo might deliver ~7–10% combined return (rental + growth) per year, depending on holding period.

- Phuket yields (~5.5–7%): With heavy tourist rental demand, Phuket’s condo yields average about 5.88% gross. Some 2-bedroom units can reach ~7% if rented as holiday rentals. Villa rental yields in Phuket are similar or slightly higher: illustrarch reports 5–7% gross for tourist-area villas. Villas in Cherng Talay or Surin Beach might command high nightly rates. Factors: yields can spike in high season but off-season vacancies occur. Overall ROI (rent + price gain) can be solid, as Phuket revalues ~5–7% per year. For instance, a villa launched in 2023 might fetch 5–7% annual appreciation on top of high rent.

- Pattaya yields (~5–6%): Rental yields in Pattaya are moderate. The same data set shows Chonburi (Pattaya) averaging ~5.42% gross. Prime condos near the beach may yield ~5–6%. Villas in Pattaya (often smaller than Phuket’s) yield similarly. Lower prices help: even modest rent (10k–15k THB/month for a condo) can yield 5–6% on a purchase of ~3–4M THB. Returns are steady given Pattaya’s consistent foreign tenant pool (especially Russians, Chinese, and retirees).

- Chiang Mai yields (~5% average): Chiang Mai typically delivers around 5% gross yield on centrally located condos. The city’s strong rental market (students, digital nomads, expats) keeps occupancy high. Some managed Airbnb condos can exceed 6%, but traditional long-term leases are about 4–5%. Houses yield similarly low (Chiang Mai house rent is low relative to price). However, ROI can still be attractive due to low entry prices and potential for price growth as the city matures (properties here are well below Bangkok’s levels).

- Hua Hin yields (~5–7%): Hua Hin investors see good returns: BambooRoutes notes 5–7% gross yield. Beachfront condos and luxury rentals do especially well. Moreover, Hua Hin’s property values have been appreciating 3–7% per year, so combined ROI is strong. Seasonal fluctuations exist (cool-season high demand), but occupancy rates have been high (85%+ in seaside projects).

- Koh Samui yields (7–10% for villas): Island properties, especially villas, post the highest yields. Illustrarch finds Samui 7–10% gross yield for luxury villas. Condominium yields on Samui are slightly lower (5–7%), but villa rentals are very lucrative due to high Airbnb rates. Example: a 4BR beach villa rented ~$500/day at 70% occupancy yields ~9–10% gross. Capital gains in prime Samui are also notable; some high-end villas have returned 25–30% total ROI (rent plus price) in a few years. The Samui market is small but highly competitive.

|

Location

|

Typical Gross Yield (residential)

|

Notes on ROI

|

|

Bangkok (CBD)

|

4%–6%

|

Yields suppressed by high prices; adding ~3–6% growth⇒ ~7–10% total ROI.

|

|

Suburban Bangkok (Nonthaburi/Samut Prakan)

|

6%–7%

|

Lower prices yield ~6–7%; steady demand from commuters.

|

|

Phuket

|

5.5%–7%

|

Strong seasonality; 5–7% yields plus ~5–7% annual price growth.

|

|

Pattaya

|

~5.4%

|

Stable long-term rental market; moderate gains.

|

|

Chiang Mai

|

~5%

|

Lower prices, 4–5% yields; growing nomad market.

|

|

Hua Hin

|

5–7%

|

High tourist occupancy; 3–7% price growth boosts returns.

|

|

Koh Samui

|

7–10% (villas)

|

Luxury yields highest; island tourist boom drives ROI (25–30% in prime).

|

Key insight: Gross yields in Thailand’s residential market average about 6%, but vary with location and property class. Generally, downtown condos yield 4–5%, while suburban and resort villas yield 6–10%. For ROI, most investors look at total returns (rental + appreciation). In a stable market, a realistic expectation might be ~6% rent + ~3–5% price gain = 9–11% total annual return for well-located buys. Much depends on timing (buying at the right point in the cycle) and management. Seasonality can cause yields to fluctuate – e.g. Bangkok has year-round steady rents, whereas Phuket/Pattaya have peak seasons.

For first-time investors, condos in Bangkok or Chiang Mai are often recommended for reliability, even if yields are modest, because they are easier to rent long-term. Villas in Phuket and Koh Samui offer the highest potential yields but require active management (Airbnb or short-term leasing). In all cases, one should calculate net yields after taxes (property tax and rental income tax) and consider financing costs.

8. Buyer Personas and Motivations

Different types of foreign buyers have distinct priorities when purchasing in Thailand. Understanding their motivations helps target the right property and location:

- Digital Nomads and Remote Workers: Often younger professionals from Europe, North America or Australia. Key concerns: high-speed internet, co-working spaces, lifestyle, and visa flexibility. Top locations: Bangkok (for urban conveniences), Chiang Mai (low cost, expat community), Phuket, or Pattaya (for beach life with good amenities). They typically seek condos (1–2BR) with modern amenities and security. They value central locations or easy commutes. They may rent out the unit when traveling. Budget can vary, but they look for good value. They tend to be risk-tolerant, focusing on capital appreciation of trending neighborhoods. Digital nomads often rely on Long-Term Residence (LTR) visas or multiple entry visas – lower investment properties are fine if it aligns with their lifestyle (co-living condos, etc.). Yield requirements are moderate since they often use the property themselves part-time.

- Retirees: Many retirees (especially Europeans, Japanese) choose Thailand for its warm climate, healthcare, and affordable living. Popular spots include Hua Hin, Chiang Mai, Pattaya, and islands like Samui or Phuket. They often buy condos (for ease) or small villas/house with garden near beaches. The motivations are lifestyle and security, not just investment. They care about nearby hospitals, expat communities, and low maintenance. In recent years, retirees have been drawn by new visa categories (e.g. the 10-year “Long Stay” visa for high spenders). Retirees typically seek stable, comfortable housing and may rent out portions occasionally. Yield isn’t their main goal, but they like to preserve capital and live on moderate income, so affordability is crucial. Areas with large retiree populations (like Jomtien in Pattaya or Black Mountain in Hua Hin) often have dedicated services (doctors, social clubs). According to market reports, foreign retirees accounted for ~40% of new purchases in Hua Hin.

- High-Net-Worth Individuals (HNWIs): Wealthy buyers from around Asia, the Middle East, Europe etc. They look for prime luxury properties: beachfront mansions in Phuket or Koh Samui, penthouses in Bangkok, villa estates in Chiang Mai’s mountains. Motivations include holiday homes, asset diversification, and prestige. Investment return is part of the equation, but often secondary to lifestyle. They demand top-quality construction, privacy, branded developments (e.g. Ritz-Carlton Residences) and turnkey service. For example, luxury villa prices in Phuket’s Cherng Talay have soared as HNWIs invest in multi-million-dollar estates. Yield is often a bonus – these buyers are comfortable with 3–4% net yields for high-end assets, knowing that appreciation in prime Thai real estate has been significant. They also appreciate Thailand’s relative stability and legal transparency compared to some emerging markets. HNW buyers in Bangkok might target luxury condo brands (e.g. Park Origin, The Met) with prices above THB 200k/sqm.

- First-Time Investors: Younger or less affluent foreigners (e.g. expats in tech) who want to buy their first property as an investment. They tend to prioritize affordability and yield. Hotspots for this group: Pattaya and Chiang Mai (for lower entry prices), or emerging Bangkok outskirts. They often look for condos under THB 4–5 million, which can still rent out. Motivated by tight budgets and learning the market, they may accept moderate yields (5–6%) if they can ride capital gains. They value simplicity of purchase, so usually avoid complex leaseholds. Some might finance via bank loans (50–70% LTV often available). Typical personas: a UK tech worker buying a Bangkok condo to rent on Airbnb when traveling, or a Singaporean investing in a Phuket condo.

- Educated Foreign Investors: These include people specifically researching real estate as an asset (analysts, fund managers). They look at data (like these tables) and focus on metrics: price-to-rent ratios, legal structure, political risks. Their properties vary widely but they often diversify across city and resort. They watch laws closely – for example, they know about Thailand’s 49% condo cap and look at projects with a transparent foreign quota. They are likely to plan 5-10 year horizons, and scrutinize developer track records and property management. Many such investors have a moderate-high risk appetite but expect professional dealings. They benefit from resources like Global Property Guide and consultancies (one published case noted yields reaching 8% on an office space in Silom, illustrating that some foreigners explore niche assets too).

Each persona drives market segments. For instance, the Myanmar buyers flocking to Thai condos in 2024 reflect both affluent and cautious escape motives (safety of Thailand real estate). Chinese and Russians have traditionally dominated luxury resort areas until recently. Meanwhile, the “digital nomad visa” launched by Thailand aims to attract wealthier foreigners who will likely become property investors too. In all cases, being investment-savvy means aligning the property type, location, and financing with the buyer’s profile. Real estate agents in Thailand often classify listings by these buyer types to better match clients (e.g. “family home for expats”, “beach condo rental performer”, etc.). A key tip: ask yourself “Why am I buying? Own use, rental income, or only capital gain?” – and choose the property accordingly. For example, a retiree might prioritize proximity to hospitals and buy in Hua Hin, whereas a flipper/investor might chase Bangkok condos with resale potential.

9. Taxes, Fees, and Transaction Costs

Buying property in Thailand incurs several government fees and taxes. Foreigners should budget for these as part of the purchase cost:

- Transfer Fee: Normally 2% of the official appraised value, paid at the Land Office when title transfers. (This is often split 50/50 between buyer and seller by agreement; sometimes the developer pays it for new projects). Special 2020-2024 relief: the Thai government reduced the transfer fee for property transfers on houses/villas under 7 million THB to just 0.01% (effectively waived) until June 2026. This creates significant savings for entry-level buyers. This is a temporary measure to stimulate sales in the mid-market. Buyers of condos or pricier homes continue to pay 2% (or 0.01% if they use the special program).

- Stamp Duty: 0.5% of the registered sale price (or appraised value). Stamp duty is only payable if no Special Business Tax (SBT) applies. For example, a sale older than 5 years (of ownership) or transactions without developer involvement typically incur the stamp duty. Often the seller pays this tax.

- Special Business Tax (SBT): 3.3% of the sale price (or appraised value) if the property is sold within 5 years of acquisition. This generally applies to individual or company sellers who sell early (developers usually cover this on new sales). If SBT is charged, the stamp duty is waived.

- Withholding Tax (WHT): Acts like a prepayment of income tax on the seller. If the seller is a Thai company, the rate is 1% of sale price or appraised value (whichever higher). If the seller is an individual, WHT is calculated on a sliding scale (as if the sale proceeds are annual income). Practically, the buyer withholds this tax and passes it to the government.

- Property Tax (Land & Buildings Tax): An annual tax on all property (on use value). Rates are low for owner-occupied residences – up to 0.3% of assessed value per year. Vacant land and commercial properties are taxed higher (up to 1.2% or more). For most foreign buyers, only the annual 0.1–0.3% applies (e.g. if you own a house, expect ≤฿500/year per million THB of value). In practice, this tax used to be minimal, as authorities often delay issuing annual bills for small amounts.

- Other Costs: Agent commissions (if used), legal fees, survey and due-diligence costs are extra. Financing foreigners should remember bank mortgage fees and currency transfer costs. Title search or escrow services may be advisable.

In sum, transaction costs typically total around 3–4% of the property value for most sales (if SBT applies) or around 5–6% if no SBT (2% transfer + 0.5% stamp + WHT). The recent government relief (0.01% transfer for ≤7M THB houses) dramatically cuts that to about 1–2% for qualifying homes. Foreign buyers should confirm who (buyer or seller) pays each tax – often sellers will want buyers to pay transfer & WHT, while buyers pay stamp duty.

10. Safe and Smart Investment Strategies

For foreigners, buying Thai property should be done cautiously but opportunistically. Here are some best practices and red flags:

- Due Diligence on Developers: Research the developer’s track record. Good developers will have completed projects on time with quality, a transparent sales process, and registered legal documents. Avoid new or small developers with no history of finish projects. Check if past buyers have complained of delays or defects. Government websites (Department of Business Development) can reveal if the company is in debt or has violations.

- Clear Title and Legal Structure: Ensure the title deed is in order. For condos, verify the foreign quota (ask for the Condominium Affidavit). For leaseholds, review the lease contract carefully – check extension clauses and restrictions. If a land lease is involved, consider registering it at the Land Department (to gain usufruct rights). Use a reputable Thai lawyer to review all documents, especially any “freehold” claims. (True freehold for anything other than condos is not allowed, so claims of “own land freehold” for foreigners should raise immediate concern).

- Check Permits and Zoning: Make sure the property is legally permitted for the intended use. For example, sometimes pool villas in certain zones were built without full permissions. Title deeds come in varieties (Chanote, Nor Sor 3, etc.); understand which one you’re getting. Prefer “Nor Sor 3 Gor” or better (English title).

- Finances and Valuation: Compare the seller’s price to market value. Many purchases fail in overpriced developments. Use independent market data to judge price. Beware “guaranteed returns” schemes (often a scam). Also consider currency risk – if funding in foreign currency, a strengthening Baht will raise cost in your own currency. Conversely, a weaker Baht could boost returns but watch Thai inflation.

- Financing Carefully: If taking a mortgage, compare Thai bank offers. Locals can borrow up to 90% on condos, but foreigners usually get ~50–70% LTV. Higher interest (around 6–8%) applies, so ensure rental yields comfortably exceed financing costs. Remember insurance and reserve capital for repairs.

- Consider Resale Demand: In Thailand, not all properties are easy to sell later. New condos off-plan are common, but more niche (very remote, or extremely luxury) projects might have limited buyer pools. If you plan to sell, choose locations and property types with broad appeal (e.g. central Bangkok condo vs. far-flung resort villa).

- Local Advice and Property Management: Work with credible real estate agents (ask for references) and property managers. They can handle leasing, maintenance, and legal updates. A good manager can be the difference between 10% occupancy and 80%.

- Case Study – Phuket Villa: For example, data shows that in 2024 new villa launches in Phuket’s luxury segment totaled ฿31.98 billion – overtaking condo launches. Savvy investors who booked early in those projects likely saw both rental demand and strong price gains as resale villa prices appreciated 5–7% in one year. The key was buying well-priced units in reputable projects before crowding in. Contrast that with some stalled condo projects where oversupply forced discounts.

- Red Flags to Avoid: According to industry guides, watch out for developers with no previous projects, unclear marketing promises, or vague land ownership structures. Avoid projects where the seller is evasive on legal details or rushes you to pay. If a deal seems too good to be true (extremely low price, “guaranteed high returns”), be skeptical. Check that all agreements (especially lease terms) are on official letterhead and notarized. Visit the site in person if possible.

- Diversify and Align with Strategy: Even within Thailand, avoid putting all capital into one project or type. A balanced approach could be: one condo in Bangkok (rental stability), plus one villa in a resort (high yield), plus liquid funds to seize opportunities. Finally, always align the investment with your goals: are you mainly after rental cash flow, long-term capital gain, or a personal retirement home? This will guide risk tolerance and financing.

In summary, smart investing in Thai property combines careful legal/market vetting with clear goals. Use available data (market reports, price indexes) and local expertise. Building relationships with trustworthy professionals (agents, lawyers, accountants) is essential. Historically, those who have done well are the ones who acted prudently: buying quality projects at a reasonable price, and maintaining them well for tenants.

11. Future Outlook for Thailand’s Property Market

Looking ahead, several factors will shape Thailand’s real estate:

- Continued Tourism Growth: Thailand aims for 35–40 million tourists annually. As travel resumes to pre-2019 levels and beyond, demand for short-term rentals (especially in Phuket, Samui, Chiang Mai) will remain high. Special tourism visas and global travel trends favor seaside destinations. More hotels and resorts are under development to cater to this surge, indirectly boosting nearby residential markets.

- Infrastructure and Policy: Major projects like the Eastern Economic Corridor (EEC) and new high-speed rail (Bangkok to Chiang Mai) will open up land and encourage international business. Improved transport (e.g. fast train, new airports) makes more regions investable. Additionally, Thailand has been launching incentives to attract affluent foreigners (10-year visa for wealthy, BOI privileges for certain investments). If these attract more high-earning expats, demand for quality housing could rise.

- Demographic Trends: Thailand is aging, and many Thais themselves may look to downsize or move to retirement hubs (Hua Hin, Chiang Mai). This could keep domestic demand stable even as birth rates are low. For foreign demand, any global economic shifts will have impacts (e.g. Chinese or Russian crises could reduce buyers from those countries as seen in 2024).

- Legal Reforms: As noted, there are proposals under consideration to loosen foreign ownership (e.g. raising condo quota to 75%). If implemented, this would open up more supply for buyers and could lead to price changes. Likewise, any shift in land lease laws (longer renewable terms guaranteed) would be welcomed by investors, especially for land/house purchases. Keeping an eye on Thai government announcements is wise.

- Economic Factors: Worldwide inflation and interest rates will influence costs. If rates stay high, Thai mortgage costs will remain above 6%, which could dampen domestic buyers. But with Thailand’s own inflation relatively controlled recently, property as an inflation hedge remains appealing. Bank of Thailand policies (like recent transfer fee cuts) also show the government’s willingness to support the sector.

- Tech and Sustainability Trends: Smart homes and green buildings are gaining traction in Thai developments. Future-proofing properties (e.g. solar panels, energy efficiency) could become value-adds. Moreover, remote work globally may continue feeding Thailand’s digital nomad scene. Government plans for co-working zones or “smart city” projects could further impact demand for urban condos.

In conclusion, Thailand’s property market is expected to remain robust and investor-friendly over the next decade. The combination of relatively low prices (compared to Singapore/Hong Kong), strong lifestyle appeal, and proactive economic policies creates a positive long-term outlook. Foreign investors should monitor new visa and tax incentives, infrastructure rollouts, and global economic trends. Those who get in now, armed with due diligence and a clear plan, position themselves well to benefit from Thailand’s growth story.

Key takeaways: Thailand’s real estate sector is a dynamic, maturing market. It offers a spectrum of opportunities – from high-yield holiday rentals to stable urban condos – but requires savvy navigation of local rules. By understanding the market data, legal landscape, and buyer profiles summarized here, foreign investors can make well-informed decisions and potentially reap attractive returns in the “Land of Smiles.”