Phuket’s condo market is booming in 2025, making it a prime target for foreign investors and expats. This comprehensive guide covers everything you need to know – from the latest market data and legal rules for foreigners, to area comparisons, investment returns, the buying process, and cost breakdowns. Whether you’re looking for a sea-view holiday home or a solid investment property, this guide will walk you through the essentials of purchasing a condominium in Phuket.

Phuket, Thailand’s largest island, remains one of Asia’s top tropical destinations. For foreign buyers and relocating expats, it offers an ideal blend of pristine beaches, warm year-round climate, modern infrastructure, and a vibrant expat community. Beyond lifestyle, Phuket’s real estate market has shown strong recovery and growth post-pandemic, driven by booming tourism and infrastructure upgrades. In 2023 alone, over 8.3 million tourists visited, directly fueling property demand as many turn vacation dreams into long-term investments.

From an investment perspective, Phuket condos deliver some of Thailand’s highest rental yields, often hitting 9–10% annually in popular areas. This surpasses returns in cities like Bangkok due to strong holiday rental demand. For instance, 1-bedroom units near the beach often rent for ฿50,000–฿60,000/month, producing yields above 10%. Property values are also on the rise—beachfront assets have appreciated at least 5% per year, with 2023 seeing 10–15% spikes in some sectors. A Phuket condo combines lifestyle enjoyment with the potential for solid passive income and capital gains.

Moreover, Thailand’s affordable cost of living and expat-friendly culture make Phuket especially attractive. The island offers modern hospitals, international schools, malls, and a growing airport—supporting both short visits and long-term living. For retirees or remote workers, Phuket delivers a resort-quality lifestyle at a fraction of the cost found in Western markets.

In short, buying a condo in Phuket in 2025 means securing both lifestyle and investment upside—a rare and compelling opportunity for foreign buyers.

Phuket’s condominium market is experiencing an unprecedented boom in 2024–2025. After a pandemic-induced dip, activity has surged to record highs. In 2023, about 3,300 condo units were sold—nearly triple the pre-pandemic average of ~1,148 units per year (2014–2019). That momentum accelerated in early 2024, with over 3,000 units sold in the first half alone, marking a 142% year-on-year increase. The demand is overwhelmingly driven by returning foreign buyers.

Foreign investment is the cornerstone of this boom. Following Thailand’s reopening, international interest has surged. Phuket Airport welcomed 6.2 million arrivals in the first 9 months of 2024, 61% of whom were foreign. Over 60% of condo sales in 2024 were to foreign buyers, with Russian nationals accounting for up to 70% of sales in some luxury beachfront projects. Other active nationalities include Chinese, Indian, European (UK, Germany, France), Australian, and American buyers.

Developers have rapidly scaled up to meet this demand. In H2 2023 alone, 24 new projects (5,900 units) were launched. By the end of 2023, Phuket’s existing condo inventory stood at around 12,188 units, with another 12,300 units planned for completion by 2028. Most launches are focused on west coast hotspots like Bang Tao, Kamala, and Patong, reflecting concentrated demand. One report noted that a new project was being introduced almost every two weeks in 2023.

Pricing trends show gradual appreciation. Despite strong demand, prices have risen moderately due to ample supply. The average listing price for a standard two-bedroom unit is around USD $296,000 (฿10–11M)—competitive when compared globally. The market shows a clear split: foreign-targeted resort condos average ฿7.7M, while local-oriented condos average ฿2.4M. Importantly, 63% of units sold in 2023–24 were priced at ฿8M or below, reflecting buyer activity in the mid-market range. Fewer transactions occurred in the luxury segment (฿10M+), as many wealthy buyers preferred villas.

In summary, Phuket’s 2025 condo market is marked by high sales volumes, strong foreign presence, rapid developer activity, and moderate price growth. Sea-view units in prime areas are selling fast, but a wide selection remains due to ongoing construction. For investors or expats, success lies in picking the right project and location based on individual goals and budget. Upcoming sections will explore legal insights, purchase steps, and top areas to consider.

One of the biggest advantages of buying a condo in Thailand is that it’s the only property type foreigners can own freehold in their name with relatively few restrictions. Still, it’s essential to understand the legal framework to ensure a smooth purchase.

Thai law limits foreign ownership in a condo project to 49% of the total sellable floor area. The remaining 51% must be owned by Thai nationals. Always confirm the foreign quota isn’t already full before buying. If it is, your options are limited to leasehold or another project.

To register the unit in your name, you must transfer funds into Thailand in foreign currency, then convert to Baht via a Thai bank. For transfers over $50,000, the bank issues a Foreign Exchange Transaction Form (FET), which is required for the Land Office registration. Funds must be sent from an account in your name to ensure compliance.

Foreigners cannot own land in Thailand. Condos, which include shared land through the building’s juristic entity, are the most direct route to ownership. Villas require land lease or corporate structures. Condos, by contrast, allow straightforward freehold title under your name if within quota.

If freehold units are unavailable or foreign funds aren't used, leasehold is a legal alternative. Thailand allows leases up to 30 years, with possible renewals. Some projects offer leasehold units to foreigners. There have been proposals to extend lease terms to 50–99 years and raise the foreign quota to 75%, but as of 2025, these are not yet law.

Buying property does not grant residency or a visa. However, investing ฿10 million+ may qualify you for a renewable 1-year investment visa. Thailand also offers a 10-year LTR visa for wealthy investors (min $500,000 property investment), and the Elite Visa (5–20 years) for a membership fee. Consult an immigration expert to choose the best fit.

Hiring a qualified property lawyer is strongly advised. They’ll check the title deed, verify the developer, and review the Sales and Purchase Agreement (SPA). Legal fees are modest—often 1% of the price or a fixed rate—and well worth the peace of mind. Contracts should be bilingual and follow consumer protection standards. Developers can’t charge foreigners more than 50% of the transfer fee, and many split or waive it.

All owners must comply with building bylaws, which govern use of common areas, pets, and rentals. Short-term rentals (under 30 days) without a hotel license are technically illegal. Some buildings prohibit them, others overlook it. Monthly or long-term rentals are legal everywhere, but check your condo’s stance if planning Airbnb use. Always clarify terms in advance.

In summary, Thailand’s laws are quite accommodating to foreign condo buyers, especially compared to neighboring countries where direct ownership may be forbidden. By adhering to the 49% foreign quota, bringing in foreign funds correctly, and following the standard procedures at the Land Department, a foreigner can obtain a freehold title to a condo unit with relative ease. Just be sure to do your homework (or engage professionals to do it) – verify the development’s legal standing, ensure contracts are fair, and understand your rights and obligations as a condo owner in Phuket. With the legal basics covered, let’s move on to the practical steps of the buying process.

Budget planning is a crucial early step in your Phuket condo purchase. Foreign buyers should go in with clear expectations about financing: Thailand is largely a cash-driven real estate market for foreigners. Traditional Thai bank mortgages are generally not available to non-resident foreigners for condo purchases. While a few banks have limited programs (for example, UOB and Bangkok Bank have in the past offered loans to foreigners under specific conditions, such as having a work permit or through their Singapore branches), these are the exception rather than the norm. Practically speaking, most expat buyers either pay cash or seek financing from their home country (like a home equity loan on property back home) if they need leverage. Developer financing is sometimes an option on off-plan projects – some developers offer installment payment plans during construction or even post-completion financing for a couple of years – but these are short-term and often at higher-than-bank interest rates.

Set a realistic budget that includes not just the property price, but also taxes, fees, and post-purchase expenses (covered in detail in a later section). As of 2025, condo prices in Phuket range widely depending on size, location, and luxury level. Broadly:

It’s helpful to get a sense of price per square meter to compare value. The table below gives approximate average condo prices per square meter in different Phuket locales (for available listings as of recent market data):

|

Area |

Avg Condo Price (฿ per m²) |

|

Patong (West coast) |

~฿130,000/m² |

|

Kamala (West coast) |

~฿105,000/m² |

|

Bang Tao/Laguna |

~฿111,000/m² |

|

Surin (West coast) |

~฿105,000/m² |

|

Kata–Karon (Southwest) |

~฿116,000/m² |

|

Rawai/Nai Harn (South) |

~฿105,000/m² |

|

Phuket Town (Central) |

~฿63,000/m² |

|

Kathu (Central) |

~฿52,000/m² |

Average asking prices per square meter in various Phuket areas. Beachfront locations on the west coast (Patong, Kata, etc.) command the highest prices, while inland areas like Kathu and the city center (Phuket Town) are more affordable.

Using these metrics, you can estimate what size and location of condo fits your budget. For instance, if your budget is ฿8 million, that could afford roughly a 70 m² sea-view condo in Kamala (at ~฿110k/m²) or a larger 120 m² unit in Phuket Town (at ~฿65k/m²). Always leave some buffer in your budget for closing costs, furnishings, and some negotiation room – in the resale market you might negotiate the price down by a few percent, whereas new developments often have fixed prices but may throw in freebies (furniture packages, waiving certain fees, etc.).

Currency considerations: Since you will likely be transferring a large sum from abroad, watch exchange rates and bank fees. The Thai Baht’s value can impact your effective cost. It’s wise to compare international transfer services or use a foreign exchange specialist to get a good rate for big transfers, as even a 1-2% difference in FX rate on a multi-million baht transfer is significant. Remember to have the funds remitted in a foreign currency to meet the legal requirements for foreign ownership (as mentioned earlier).

Tax planning: If you are financing through personal funds, consider any tax implications in your home country for moving money or selling assets to fund the purchase. Thailand itself has no property acquisition tax for the buyer beyond the transfer fees discussed later, but some buyers’ home countries might tax worldwide assets or require reporting. Consulting a tax advisor for large investments abroad is never a bad idea to ensure you structure the purchase optimally.

Buying a condo in Phuket as a foreigner is straightforward if you follow these five key steps:

Set clear goals:

Use trusted portals (e.g., FazWaz) or hire a local agent (typically paid by seller). Agents can offer curated shortlists and virtual tours. Research developers, compare prices, and explore expat forums before viewing.

Visit shortlisted properties in person if possible. Evaluate:

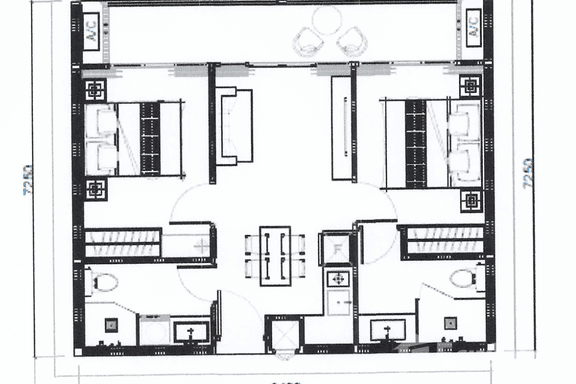

Request floor plans, title deed copies, and juristic rules. Older buildings may require renovations—check before committing.

Negotiations often include sharing the 2% transfer fee. Developers may cover some fees as incentives. Ensure all terms are in writing.

Hire a lawyer to:

Once cleared, sign the SPA. For off-plan, pay ~30% upfront. For resales, full payment is typically due at transfer.

Your lawyer or agent will prepare a breakdown and guide you through.

You’re now the legal owner. Update the condo juristic office, register for utilities, and begin enjoying or renting your unit.

Typical timeline: 30–60 days (faster for resales, longer for off-plan).Tip: Use pros—lawyers, agents, and local knowledge—to reduce risk and stress.

Phuket offers diverse locales, each with its own character, pros/cons, and price levels. Deciding where in Phuket to buy is just as important as the condo itself. Below we compare some of Phuket’s most popular areas for foreign condo buyers, along with internal links to explore condo listings in each:

Patong is Phuket’s busiest beach town, famous for nightlife, dining, and shopping. It's ideal for investors targeting short-term rentals and high occupancy.

Kamala offers a relaxed vibe with upscale condos and villas, ideal for buyers wanting proximity to Patong but with more tranquility.

This area blends long beaches with resort-style living. Laguna is a gated enclave with golf, luxury condos, and a strong expat community.

Surin is a small upscale area with luxury condos and villas along Millionaire’s Mile, known for exclusivity and sea views.

Laid-back beach towns popular with families and couples. Offer a mix of affordability and beach access without Patong’s chaos.

A favorite among retirees and long-stay expats. Nai Harn has a swimmable beach; Rawai is more of a residential fishing village.

Not beachfront, but full of Thai charm, history, and conveniences. Suits professionals and those preferring a city vibe.

Each area in Phuket has its unique appeal – there’s truly something for everyone on the island. It’s wise to spend time in your preferred area before buying (stay a week or two if you can) to ensure the vibe suits you. Also consider future developments: Phuket is continually upgrading its infrastructure (plans for a light rail tram from the airport down to Chalong are in the works, for example), which could make some areas even more accessible in the coming years.

For many foreign buyers, an important factor in purchasing a Phuket condo is the investment return – both in terms of rental yield and capital appreciation. Here’s a look at what you can expect:

As mentioned earlier, Phuket boasts some of the highest gross rental yields in Thailand. On average, Phuket condos can yield around 6–9% gross annually, with well-managed holiday rentals in prime locations achieving even higher. According to a 2023 report, Phuket’s rental market was so strong post-pandemic that average yields reached 9–10%, roughly double the typical 4–5% yields seen in Bangkok. This boom has been driven by the tourism rebound and a shortage of rental supply during peak seasons.

Phuket’s rental demand looks robust going forward. With Thailand aiming to hit pre-pandemic tourist numbers by 2025 (the country saw 28 million visitors in 2023 and projections for 2024–2025 are even higher), Phuket as a premier destination will continue to attract visitors needing short-term accommodation. Moreover, a growing expat community (many on new LTR visas or remote workers) is driving long-term rental demand. Occupancy rates in popular expat areas have been climbing; for instance, Laguna long-term occupancy hit ~80% recently, higher than historical norms.

Phuket real estate has shown good long-term appreciation. Historically, values were on a steady rise pre-2020, with a notable dip during the pandemic (some fire-sales occurred in 2020–2021 when tourism shut down). However, the recovery has not only erased those dips but pushed prices to new highs in many areas. For example, beachfront property values jumped by up to 15% in 2023 alone, the highest growth rate recorded. Overall, a local agency report claimed Phuket property prices have risen over 400% since 2004 (that year had a low base due to the tsunami) – that averages out to ~7% annual growth compounded over 20 years.

Realistically, going forward one might expect moderate appreciation in most segments – perhaps on the order of 3-6% per year – as Phuket’s market matures. The high double-digit surge of 2022–2023 was partly a post-pandemic catch-up. Yet, there are reasons to be optimistic about continued growth:

Exit Strategy: If you think about selling in the future, note that the buyer pool for Phuket condos includes both international and Thai buyers. Thais have also increasingly bought Phuket condos (some for holiday homes, others for rental investment), particularly with the recent boom. For a foreign owner, selling to another foreigner requires that foreign quota is available for the unit – since you occupied one foreign slot, selling your unit as foreign freehold is straightforward (the quota slot goes to the new foreign buyer). If for some reason foreign quota were full at that time, you could still sell to a Thai buyer as a Thai freehold unit, converting the quota share – this flexibility is nice.

Overall Investment Takeaway: A well-chosen condo in Phuket can offer a combination of solid rental income and capital growth. Many investors use rental returns to cover carrying costs (and even finance costs if any) while patiently holding the asset as it appreciates. The key is to select a property that will remain desirable for the long run – good location, quality construction, and in a development with sound management. Look at track records: some older condos in Phuket (15-20 years old) have maintained or even increased their value, while others that were poorly built have stagnated or needed costly renovations. E-A-T (Expertise-Authoritativeness-Trustworthiness) in your investment means doing due diligence on the developer, the condo juristic’s financial health, and perhaps sticking to known areas where resale demand is always present.

Beyond the sticker price of the condo, foreign buyers should be aware of the various costs involved in purchasing and owning a Phuket condo. Here’s a breakdown:

Overall, owning a condo in Phuket is relatively low-overhead compared to landed houses, where you’d have garden and pool maintenance, etc. The CAM fee is the main ongoing cost, and it ensures you enjoy clean common areas, security, and facility upkeep. Always pay your CAM fees on time – Thai law allows the condo management to put a charge against your unit for unpaid fees, which can complicate matters.

It’s also wise to keep an emergency fund for your property. While condos are fairly hassle-free, things like a sudden need to replace an aircon compressor or fix a plumbing leak can occur. A few thousand baht here and there in maintenance is part of the equation, but certainly the ROI from rentals can cover these if you’re renting it out.

Just briefly, for completeness: if one day you sell the condo, the taxes/fees we outlined (transfer 2%, stamp/SBT, withholding) will come into play again, but you’ll be on the other side. Typically, as a foreign seller, you’d factor in paying those or adjust price accordingly. Using an agent to sell will cost ~3% commission. But one advantage – if you made a profit, Thailand does not have a separate capital gains tax for individuals; the only tax is that withholding which is like income tax on a prescriptively calculated gain (which long-term holders benefit from via deductions). Many investors appreciate that Thailand’s transaction costs are moderate and there’s no annual punitive taxes, making it friendly to buy-and-hold strategies.

With the costs and process demystified, you are well-equipped with knowledge to venture into Phuket’s condo market. But information alone isn’t enough – aligning with trustworthy professionals on the ground (agents, lawyers, maybe a friend who’s done it before) will make your buying journey much smoother and safer.

Phuket in 2025 stands out as a prime destination for foreign condo buyers, blending an alluring tropical lifestyle with strong investment fundamentals. We’ve covered a lot of ground in this guide – from the booming market stats and legal must-knows to neighborhood insights, ROI potential, and the step-by-step purchase process. By now, you should have a clear roadmap for buying a condo in Phuket and what to expect along the way.

A few final thoughts to maximize your success:

Lumpini Ville Ramkhamhaeng 44

Garden Condo Huamark

Lumpini Center Happyland